Municipal Tourist Tax Regulations in Portugal: A comparative analysis

Resumen

Our research has explored the complex landscape of Municipal Tourist Tax regulations across Portuguese municipalities that currently impose a tourist tax on overnight stays. The introduction of a tourist tax in Portugal first occurred in Aveiro in 2013. However, its implementation and collection did not achieve the expected impact, so it was discontinued. Many Portuguese municipalities now impose the tourist tax, including popular destinations such as Porto, Lisbon, and Faro, offering a unique opportunity to assess the evolving regulatory landscape and its effects on local economies. This study examined and compared the Portuguese regulations in force at the end of 2023. The analysis focused on the date of application, incidence, value, purpose, and exemptions of the tourist tax applied in the various municipalities, providing insights into the effectiveness and challenges of these tax policies in Portugal. The research will not only contribute to the scholarly understanding of municipal tourist tax dynamics but also offer practical implications for policymakers, local authorities, and the broader tourism industry.

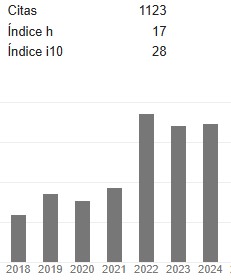

Descargas

Citas

Adedoyin, F., Seetaram, N., Disegna, M., & Filis, G. (2023). The effect of tourism taxation on international arrivals to a small tourism-dependent economy. Journal of Travel Research, 62(1), 135-153. https://doi.org/10.1177/00472875211053658

Alves, C. (2019). Turismo em Portugal: Aplicação da taxa municipal turística. Master’s Dissertation, ISCTE Business School.

Biagi, B., Brandano, M. G., & Pulina, M. (2017). Tourism taxation: A synthetic control method for policy evaluation. International Journal of Tourism Research, 19(5), 505-514. https://doi.org/10.1002/jtr.2123

Borges, A., Vieira, E., & Gomes, S. (2020). The evaluation of municipal tourist tax awareness: The case of the city of Porto. Tourism and Hospitality Management, 26(2), 381-398. https://doi.org/10.20867/thm.26.2.6

Costa, A. (2016). O impacto da taxa turística no Norte de Portugal. Master’s Dissertation, University Católica of Porto.

Costa, R. (2017). A tributação turística municipal: O caso do Município de Lisboa. Coimbra: Edições Almedina.

Do Valle, P., Pintassilgo, P., Matias, A., & André, F. (2012). Tourist attitudes towards an accommodation tax earmarked for environmental protection: A survey in the Algarve. Tourism Management, 33(6), 1408-1416.https://doi.org/10.1016/j.tourman.2012.01.003

Elo, S., Kääriäinen, M., Kanste, O., Pölkki, T., Utriainen, K., & Kyngäs, H. (2014). Qualitative content analysis. SAGE Open, 4(1). https://doi.org/10.1177/2158244014522633

Gago, A., Labandeira, X., Picos, F., & Rodríguez, M. (2009). Specific and general taxation of tourism activities. Evidence from Spain. Tourism Management, 30, 381-392. https://doi.org/10.1016/j.tourman.2008.08.004

García, A., Marchena, M., & Morilla, A. (2018). Sobre la oportunidad de las tasas turísticas: el caso de Sevilla. Cuadernos de Turismo, 42, 161-183. https://doi.org/10.6018/turismo.42.07

Gooroochurn, N., & Sinclair, M. T. (2005). Economics of tourism taxation: Evidence from Mauritius. Annals of Tourism Research, 32(2), 478-498. https://doi.org/10.1016/j.annals.2004.10.003

Goktas, L. S., & Polat, S. (2019). Tourist tax practices in European Union member countries and its applicability in Turkey. Journal of Tourismology, 5(2), 145-158. https://doi.org/10.26650/jot.2019.5.2.0026

Gusman, I., Rio Fernandes, J. A., & Chamusca, P. (2023). Back to business? Taking lessons from Porto (Portugal) to inform sustainable tourism futures after COVID-19. Boletín de la Asociación de Geógrafos Españoles (99). https://doi.org/10.21138/bage.3448

Harvey, D. (2013). Ciudades rebeldes: del derecho de la ciudad a la revolución urbana. Ediciones Akal, Madrid.

Ihalanayake, R. (2013). Tourism taxes and negative externalities in tourism in Australia: A CGE approach. Corporate Ownership & Control, 10(4), 200-214.

Ihalanayake, R., & Divisekera, S. (2006). The tourism tax burden: Evidence from Australia. Tourism Economics, 12(2), 247-262. https://doi.org/10.5367/000000006777637421

Law no. 73/2013, Assembleia da República, Diário da República: I Série, no. 169 (2013). https://diariodarepublica.pt/dr/legislacao-consolidada/lei/2013-105795409

Law no. 53-E/2006, Assembleia da República, Diário da República: I Série, no. 249 (2006). https://diariodarepublica.pt/dr/legislacao-consolidada/lei/2006-212243428

Lee, S. (2014). Revisiting the impact of bed tax with a spatial panel approach. International Journal of Hospitality Management, 41, 49-55. https://doi.org/10.1016/j.ijhm.2014.04.010

López-del-Pino, F., Grisolía, J., & Ortúzar, J. (2020). Is there room for a room tax in the Canary Islands? International Journal of Tourism Research, 23(5), 743-756. https://doi.org/10.1002/jtr.2438

Mak, J. (2006). Taxation of travel and tourism. In P. Forsyth & L. Dwyer (Eds). International handbook on the economics of tourism (pp. 251-265). Edward Elgar Publishing Limited.

Milano, C. (2017). Overtourism y turismofobia. Tendencias globales y contextos locales. Ostelea School of Tourism & Hospitality. https://acortar.link/00q8n1

Nepal, R., & Nepal, S. (2021). Managing overtourism through economic taxation: Policy lessons from five countries. Tourism Geographies, 23(5/6), 1094-1115. https://doi.org/10.1080/14616688.2019.1669070

Peeters, P., Gössling, S., Klijs, J., Milano, C., Novelli, M., Dijkmans, C., Eijgelaar, E., Hartman, S., Heslinga, J., Isaac, R., Mitas, O., Moretti, S., Nawijn, J., Papp, B., & Postma, A., (2018). Research for TRAN Committee - Overtourism: impact and possible policy responses. European Parliament, Policy Department for Structural and Cohesion Policies, Brussels. https://acortar.link/A40AZA

Ponjan, P., & Thirawat, N. (2016). Impacts of Thailand’s tourism tax cut: A CGE analysis. Annals of Tourism Research, 61, 45-62. https://doi.org/10.1016/j.annals.2016.07.015

SIC Notícias. (2019). Vai viajar na Europa? Saiba o valor das taxas turísticas. https://sicnoticias.pt/economia/2019-01-04-Vai-viajar-na-Europa—Saiba-o-valor-dastaxas-turisticas

Vareiro, L., Miranda, E., & Gonçalves, S. (2023). Exploring motivations behind accommodation tax in Portuguese municipalities: A press reading. In A. Teixeira, A. P. Delgado, L. Carvalho, M. I. Mota & M. M. Castro e Silva (Eds.), Estudos de Homenagem a José da Silva Costa (pp. 710-721). Porto Press.

WTO. (1998). Tourism taxation: Striking a fair deal. World Tourism Organisation.

Regulations consulted

Regulation no. 382/2016 of Município de Cascais, Diário da República: II Série, no. 73 (2016). https://diariodarepublica.pt/dr/detalhe/regulamento/382-2016-74145437

Regulation no. 723/2018 of Município de Vila Real de Santo António, Diário da República: II Série, no. 207 (2018). https://diariodarepublica.pt/dr/detalhe/regulamento/723-2018-116791434

Regulation no. 773/2018 of Município de Óbidos, Diário da República: II Série, no. 219 (2018). https://diariodarepublica.pt/dr/detalhe/regulamento/773-2018-116963791

Notice no. 19334-A/2018 of Município de Lisboa, Diário da República: II Série, no. 248 (2018). https://diariodarepublica.pt/dr/detalhe/aviso/19334-a-2018-117487474

Public Notice no. 1022/2019 of Município de Braga, Diário da República: II Série, no. 175 (2019). https://diariodarepublica.pt/dr/detalhe/edital/1022-2019-124642728

Regulation no. 725/2019 of Município de Faro, Diário da República: II Série, no. 178 (2019). https://diariodarepublica.pt/dr/detalhe/regulamento/725-2019-124750449

Regulation no. 652/2022 of Município de Vila Nova de Gaia, Diário da República: II Série, no. 136 (2022). https://diariodarepublica.pt/dr/detalhe/regulamento/652-2022-186145829

Regulation no. 1111/2022 of Município de Santa Cruz, Diário da República: II Série, no. 219 (2022). https://diariodarepublica.pt/dr/detalhe/regulamento/1111-2022-203367383

Regulation no. 1135/2022 of Município do Porto, Diário da República: II Série, no. 226 (2022). https://diariodarepublica.pt/dr/detalhe/regulamento/1135-2022-203803584

Regulation no. 1182/2022 of Município de Póvoa de Varzim, Diário da República: II Série, no. 243 (2022). https://diariodarepublica.pt/dr/detalhe/regulamento/1182-2022-204991668

Regulation no. 207/2023 of Município de Mafra, Diário da República: II Série, no. 33 (2023). https://diariodarepublica.pt/dr/detalhe/regulamento/207-2023-207483822

Regulation no. 352/2023 do Município da Figueira da Foz, Diário da República: II Série, no. 56 (2023). https://diariodarepublica.pt/dr/detalhe/regulamento/352-2023-210488240

Notice no. 5970/2023 of Município de Coimbra, Diário da República: II Série, no. 57 (2023). https://diariodarepublica.pt/dr/detalhe/aviso/5970-2023-210520547

Notice no. 6116/2023 of Município de Sintra, Diário da República: II Série, no. 58 (2023). https://diariodarepublica.pt/dr/detalhe/aviso/6116-2023-210537223

Regulation no. 664/2024 of Município de Olhão, Diário da República: II Série, no. 115 (2024). https://diariodarepublica.pt/dr/detalhe/regulamento-extrato/664-2024-868658480

Derechos de autor 2025 Laurentina Vareiro, Soraia Gonçalves, Eva Maria Miranda, Raquel Mendes

Esta obra está bajo licencia internacional Creative Commons Reconocimiento 4.0.

En caso de que el manuscrito sea aprobado para su publicación, los autores/as conservan los derechos de autor y ceden a la revista el derecho de la publicación, edición, reproducción, distribución, exhibición y comunicación tanto en el país de origen como en el extranjero, mediante medios impresos y electrónicos en diferentes bases de datos. Por lo tanto, se establece que después de la publicación de los artículos, los autores/as pueden realizar otros acuerdos independientes o adicionales para la difusión no exclusiva de la versión del artículo publicado en la presente revista (por ejemplo, en libros o repositorios institucionales), siempre que se indique explícitamente que el trabajo fue publicado por primera vez en Turismo y Patrimonio.

.jpg)

Los artículos publicados se encuentran disponibles en acceso abierto bajo la licencia

Los artículos publicados se encuentran disponibles en acceso abierto bajo la licencia